how are property taxes calculated at closing in florida

For the Florida median home value of 252000 this comes to 1512 outside of Miami-Dade or 1764 inside Miami-Dade. Hence the best way to ensure you will have the property tax in place before during and after the closing is to work with an expert title and escrow company.

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Cape Coral

With Florida closings the property taxes collected will be based on the prior year and adjustments will be made in November.

. One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable. Using the same example 35 per day for 104 days equals 3640. When buying a house ownership is transferred from the seller to the new owner.

Ad Enter Any Address Receive a Comprehensive Property Report. This is the amount of prorated tax the seller owes at closing. This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your buyers side the only cons is you need to have the value presented already otherwise you need to do the calculation to get that value.

Customarily full-year real estate taxes are remitted upfront when the year starts. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Unsure Of The Value Of Your Property.

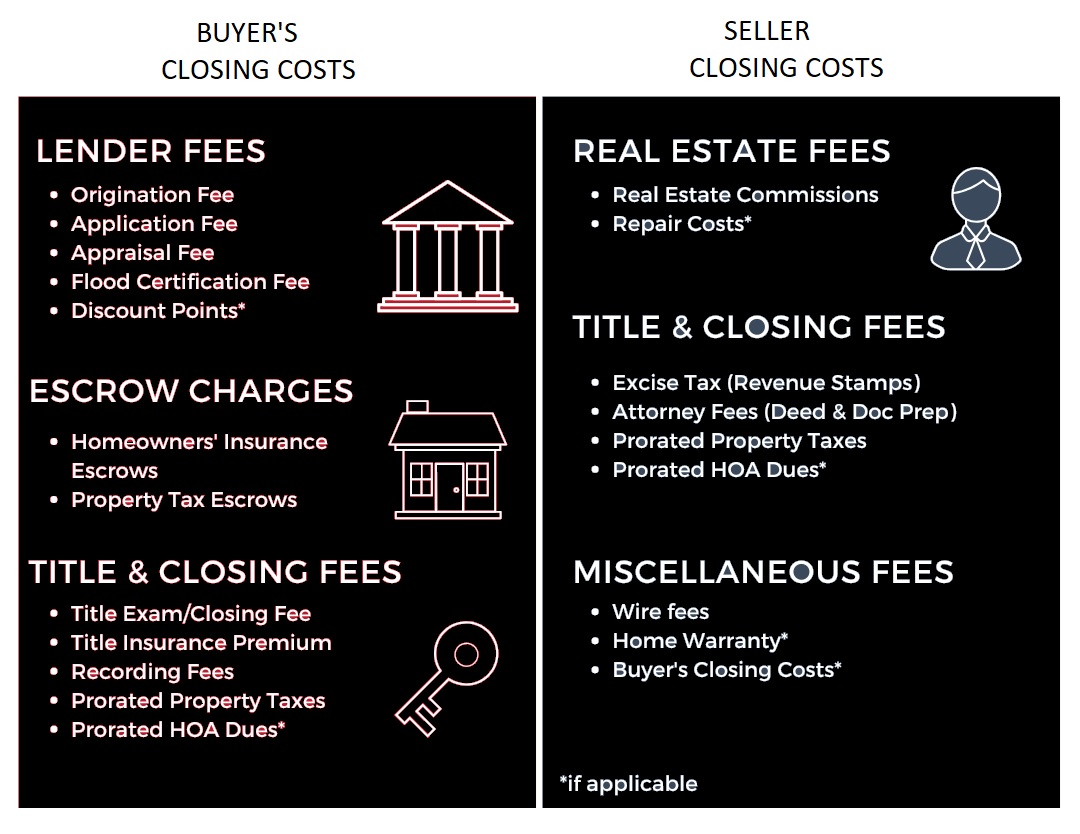

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. Then who pays property taxes at closing if it occurs mid-year. Determine the sellers amount due.

Use our Florida seller closing costs calculator to see how much youll owe at closing. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed. Proportion Calculation - X sellers of days total amount tax 365 days.

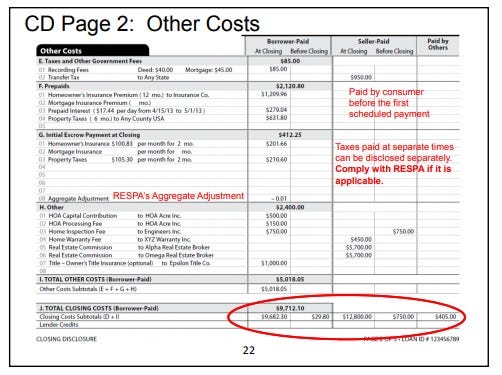

Heres how to calculate property taxes for the seller and buyer at closing. During the closing process all parties typically sign a re-proration agreement which states that the property taxes will be re-calculated upon the arrival of the tax bill. Dealing with property taxes during a real estate closing in Florida can be a stressful and time-consuming situation especially when you have to calculate all the related costs.

The more valuable the. Choose paid or not paid. Divide the total annual amount due by 12 months to get a monthly amount due.

Simply close the closing date with the drop down box. 4200 12 350 per month. The millage rate for Boca Raton is 18307 per 1000 of value so you are paying.

Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes. Find All The Record Information You Need Here. Everywhere in Florida outside of Miami-Dade County its calculated at 60 cents per 100 of the value on the deed.

6 x 350 2100 1167 x 26 30342 for a total of 240342. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. Multiply the total number of days by the daily tax amount.

When it comes to real estate property taxes are almost always based on the value of the land. The seller is responsible for 6 months and 26 days. To calculate the property tax use the following steps.

See Results in Minutes. Since property taxes are based on the prior year when the tax bill finally comes all parties involved should re-prorate the taxes in order to determine who owes what. Find the assessed value of the property being taxed.

Florida seller closing costs will be around 625 to 90 of the homes final sale price that includes real estate agent commissions. How Are Property Taxes Handled at Closing in Florida. During the home closing process the title company youre working with will prorate the taxes between the buyer and the seller at closing based on the closing date.

For the median home value in Florida 388635 1 thats between 23290 and 34980. Knowing how to calculate your property tax expense is important in knowing whether you can afford a particular home. Likewise liability for the tax goes with that ownership transfer.

Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. FROM - 112018 TO - 12312018.

The pro-ration of the property taxes between the buyer and seller becomes a little less precise when the closing date falls between January and the date the actual property tax bill comes out since this period will be based upon a property. Then enter the local county and school tax amount and enter the tax period ie.

Blog Royal Shell Real Estate Real Estate

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Real Estate Guide Home Mortgage Mortgage Home Buying

What Every Buyer Needs To Know About Closing Costs

Your Guide To Prorated Taxes In A Real Estate Transaction

7 Tips For First Time Home Buyers Home Buying Process First Time Home Buyers Home Ownership

The Home Buying Road Map How To Buy A House Home Buying Process Home Buying First Time Home Buyers

First Time Home Buying From A First Time Home Buyer

Property Tax Prorations Case Escrow

Closing Costs Calculations Practice Video Lesson Transcript Study Com

What Should Homebuyers Ask Themselves Before Entering The Market

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Closing Costs In Florida What You Need To Know

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Closing Costs Calculations Practice Video Lesson Transcript Study Com